Coronavirus Update

The media, both mainstream and social, are once again serving themselves more than the public interest, while Governments around the world are in panic mode. Combine a global pandemic with an oil price war and watch global stock markets pullback faster then ever before.

Given the backdrop it is perfectly normal for shares to fall and we would expect the drop to be exaggerated. We should also be mindful that ‘forced sellers’ can push the market lower after a sustained period of volatility. However, the extent to which we have experienced losses, especially over the last few days, is entirely irrational. Badly coached investors are making ill-informed decisions.

The markets will rebound, but investors need to be patient, ignore the hype and ride it out. Markets may go down further from here temporarily; it could snap back very quickly or gradually rise as the newsflow turns more positive. But it will rebound, and it is impossible to time the market successfully.

We do not know the extent of the economic damage the virus will cause, but Central Banks globally have taken early action. Also, Governments have and will continue to provide support to both businesses and individuals who need it. Financial support is likely to be maintained and increased for as long as necessary. We would also expect the lack of Global coordination to be addressed.

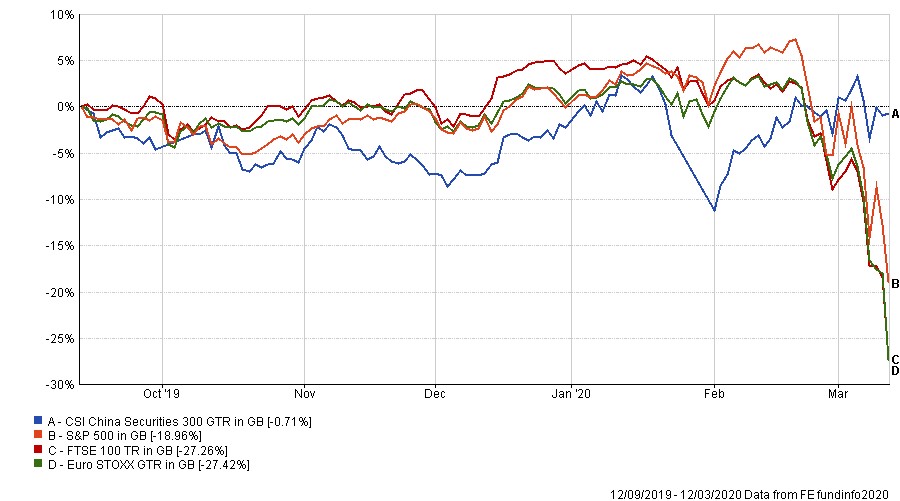

In China, new cases of the disease have fallen into the single numbers for two days running. It is reported that all 14 temporary hospitals have been closed. And while supply chains have been disrupted, Wuhan is getting back to normal. China is recovering and their blue chip stock market equivalent, the CSI 300, has behaved more rationally. The chart below provides a comparison of the major markets over the last six months. China has outperformed the US, UK and European Markets.

Understandably, there is much uncertainty about the next few months and each country will face the Virus in their own way. Sir Patrick Valance, the UK’s Chief Scientific Officer (take a look at his background https://www.gov.uk/government/people/patrick-vallance) is much better positioned to guide us through this than Facebook fearmongers encouraging you to acquire a year’s supply of toilet paper.

As always, we are here to help you. If you have any queries or concerns please get in touch.

Disclaimer

Issued by Sterling Financial Services Ltd, which is regulated and authorised by the Financial Conduct Authority. The contents of this update do not constitute advice and should not be taken as a recommendation to purchase or invest in any of the products mentioned. Before taking decisions, we suggest you seek advice from one of our qualified and authorised financial advisers. All figures and the information provided are correct at the time of writing. Past performance is not necessarily a guide to future returns, and the value of investments can fall as well as rise. You may get back less than you have invested. If you have any comments or suggestions on how to improve the monthly update or would like to be removed from our current email list, then please send an email to info@sterlingfs.co.uk or use the unsubscribe link below.