The Rebound

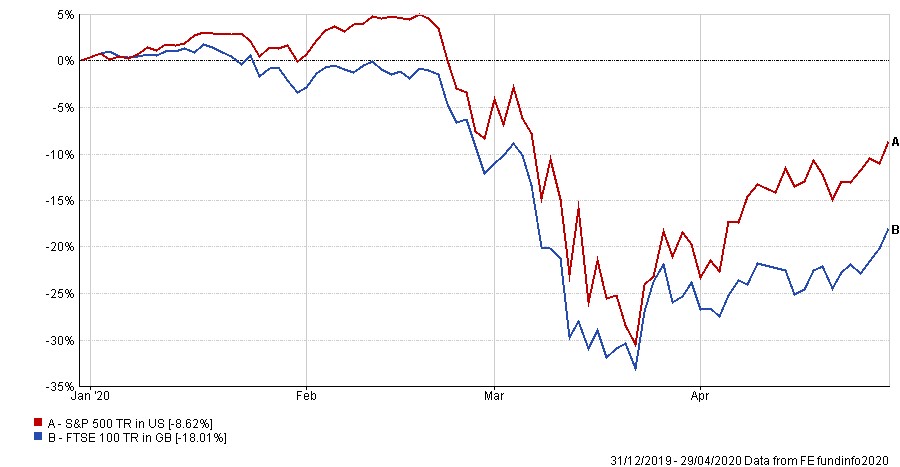

Valuations have improved significantly since their March lows. The FTSE 100 has increased by over 20% and the American S&P 500 is over 30% higher. However, as the chart below demonstrates, they are still some way off where they started the year.

Your money is allocated to a wide range of investments and the diversification has provided some protection. However, the lower-risk investments held within our recommended strategies can only do so much. Major stock indexes, like the FTSE and S&P, contribute significantly to the performance and volatility of your portfolio, which has resulted in negative returns so far this year.

The sharp rebound in equity prices has taken many by surprise during the last few weeks. The global economy has almost entirely shut down and it is impossible to predict the real economic damage caused by the virus. Those companies that were considered resistant, food retailers, for example, are providing mixed results. While sales have increased substantially, the cost of operating safely is more expensive, impacting profit.

Many countries have started to relax their containment measures. If the ‘phased’ return to normality can be managed successfully, there is every reason to believe that the recovery will become more robust. We can take some reassurance from South Korea, where no new domestic infections were recorded yesterday. Also, as the weeks pass by, we move ever closer to a vaccine.

Unquestionably, the scale of the global monetary response has supported markets, but it does feel that valuations have moved higher and more rapidly than justified. Investors, even in the cautious strategies, should prepare for both big steps forward and back over the next few months, but we remain comfortable that those with patience will ultimately be rewarded.

In summary, the economic impact of the virus will be felt for a long time to come, but we are starting to see some encouraging news. The increase in equity markets in recent weeks, while very welcome, is unlikely to be sustainable until the pandemic shows real signs of easing throughout the US and Europe.

We are constantly reviewing the progress of the portfolios and trying to forward think how the world may look at the end of the pandemic. For the time being, we remain happy to let the current approach run its course, but we will be recommending some adjustments when markets become more settled.

In the meantime, if you have any concerns or queries please feel free to contact us.

Disclaimer Issued by Sterling Financial Services Ltd, which is regulated and authorised by the Financial Conduct Authority. The contents of this update do not constitute advice and should not be taken as a recommendation to purchase or invest in any of the products mentioned. Before taking decisions, we suggest you seek advice from one of our qualified and authorised financial advisers. All figures and the information provided are correct at the time of writing. Past performance is not necessarily a guide to future returns, and the value of investments can fall as well as rise. You may get back less than you have invested. If you have any comments or suggestions on how to improve the monthly update or would like to be removed from our current email list, then please send an email to info@sterlingfs.co.uk or use the unsubscribe link from the Mailchimp email.