Wealth Tax

With the COVID bailouts continuing at pace, attention is starting to focus on the mounting debt pile and how it will ultimately be repaid. This, coupled with rising inequality, has led the media to speculate that a Wealth Tax may be introduced.

A Wealth Tax is simply a tax charge based on the size of your wealth, rather than your income or the profit from your investments. Annual wealth taxes are used in several countries but tend to generate a very small amount of the total tax revenue raised. In Spain for example, citizens pay a progressive tax on assets exceeding €700,000, starting at 0.24%, increasing to just over 3% for those with significant wealth. There are some exemptions for residential property, private business and pension savings. Overall, annual wealth taxes make up less than 1% of all Spanish tax revenue.

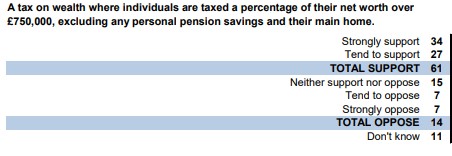

It should be of no surprise that, when the bar is set high enough, Wealth Taxes are not unpopular amongst the electorate. A recent YouGov survey (summarised in the table below) of around 1800 people, from across the political spectrum, showed that only 14% opposed a tax on wealth above £750,000 (excluding pension and main residence).

COVID aside, there has been an argument for taxing wealth for some time. Thomas Pikkety, the author of Capital in the 21st Century, studies the increasing ratio of wealth to income. He explains that if the exponential rise in wealth amongst the few is not controlled, inherited wealth will bring about social and economic instability. Regardless of your political persuasion, significant inequality will have consequences.

Others argue that the Government has no right to arbitrarily take from individuals who have already paid tax on the wealth they have accumulated. It discourages a savings culture and negatively impacts entrepreneurship and the wealth creators of tomorrow.

Our view is that the introduction of an annual Wealth Tax is unlikely. The simple truth is that if regularly taxing your wealth were easy, it would already be in place. Wealth taxes can be difficult to calculate and often easily avoided, especially amongst the globally mobile. The French dropped their Wealth Tax in 2017. Inequality was addressed in part, not because of the greater tax revenue, but because of the exodus of the wealthy.

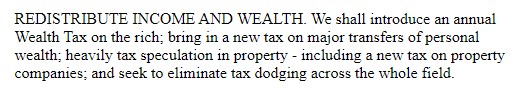

The cost of calculating and collecting the tax would outweigh any potential benefit. Also, introducing a wealth tax system would require greater global co-operation during a time of greater protectionism. The UK has never applied a Wealth Tax of this nature, even with Labour’s 1974 manifesto pledge: –

This still leaves a potentially £300 billion COVID shaped hole in the Government’s balance sheet and an environment of rising inequality.

On the positive side, the repayment of the debt can be a gradual process. It took 98 years for the UK to settle its World War 1 debt. Borrowing terms are very attractive and with the rest of the world facing similar problems, exchange rate issues are less of a concern.

Ultimately, we envisage a broad range of tax rises to help reduce the debt. There will inevitably be higher taxes on those in more privileged positions, with an Inheritance Tax increase the most likely tool to combat inequality.

We will be in touch next week with a progress report of the markets and our models, but should you have any queries please feel free to contact us.

Disclaimer Issued by Sterling Financial Services Ltd, which is regulated and authorised by the Financial Conduct Authority. The contents of this update do not constitute advice and should not be taken as a recommendation to purchase or invest in any of the products mentioned. Before taking decisions, we suggest you seek advice from one of our qualified and authorised financial advisers. All figures and the information provided are correct at the time of writing. Past performance is not necessarily a guide to future returns, and the value of investments can fall as well as rise. You may get back less than you have invested. If you have any comments or suggestions on how to improve the monthly update or would like to be removed from our current email list, then please send an email to info@sterlingfs.co.uk or use the unsubscribe link from the Mailchimp email.