The Recovery

The market rally, which started in the last week of March, has continued well into June. There have been volatile periods along the way, not least the FTSE’s 4% drop yesterday, but the trend has been upwards. The sharp rise in valuations overall has been fuelled by the ‘whatever it takes’ response from Governments and Central Banks globally, combined with the containment of the virus for much of the world. Although most investors are still recovering lost ground, the speed of the recovery so far has been very welcome. From an investment standpoint, we remain nervous and fully expect volatility to continue, but it feels like the worst is behind us. The real economy will take much longer to heal, but while fiscal and monetary life support continues and potentially increases, we can have some confidence that a persistent slump has been avoided.

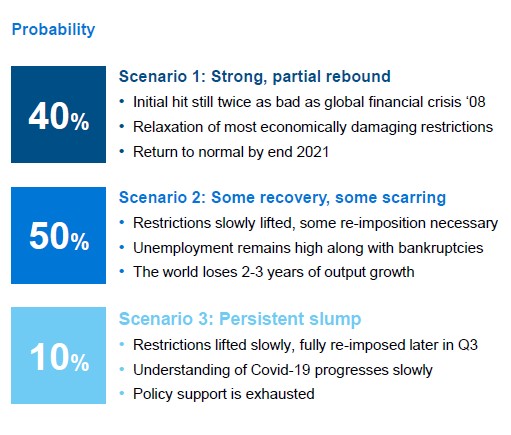

Because our knowledge of the virus remains limited and the damage to the real economy unclear, the trajectory of the economic recovery is debatable. We found a recent presentation from Legal and General’s investment team helpful. The graphic below illustrates the probability in percentage terms of the speed of the recovery between three different scenarios: –

The global economy clearly faces many headwinds. The underlying economic damage caused by the virus is difficult to gauge and largely disguised by the global Government intervention. The UK workforce has been mostly protected, but as the furlough scheme is withdrawn, redundancies are widely anticipated. The United States saw its unemployment rate spike to nearly 15% in April, from 3.6% in January. Unlike the UK, where employers are distributing the furlough benefit, US citizens are receiving enhanced unemployment benefits directly from their Government. This provides a clearer indication of the real damage to jobs.

Even if we discount the risk of a second wave of the virus and large-scale jobless claims, geopolitical tensions are escalating. China’s relationship with Western society has deteriorated. Investors will be fearful of a return of the trade wars that held markets back during 2018. Brexit friction has increased in recent weeks, which we can expect to grab the headlines as the virus subsides. The US elections may bring about a move towards the left and a less business-friendly environment.

The backdrop does make for a volatile period in the short term, but investors have recognised that the medium-term prospects for the markets are favourable, especially from the depressed levels we have experienced over the last few months. When the short-term headwinds are overcome, we would expect that the unprecedented economic intervention becomes a tailwind.

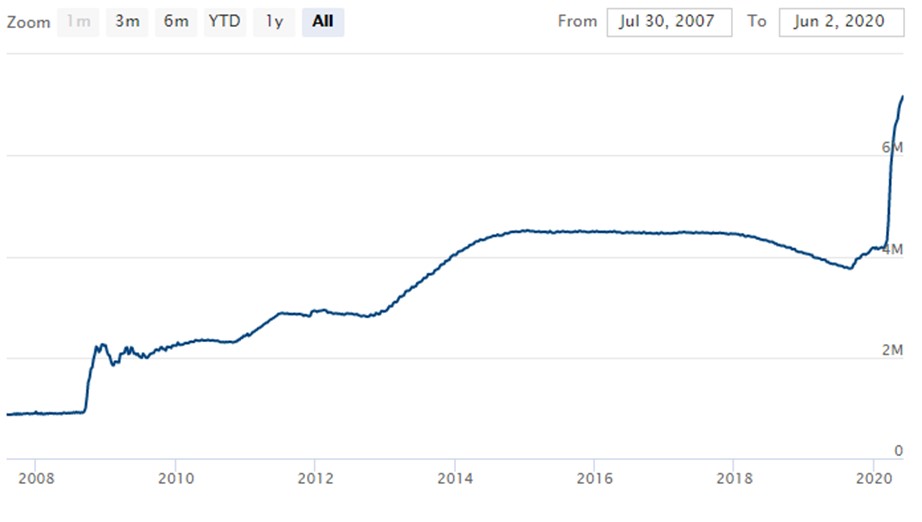

Investors cannot ignore the astonishing measures Governments globally are prepared to take to mitigate the impact of the pandemic and how this positively impacts investment markets. The chart below measures the Federal Reserve’s balance sheet since August 2007.

The chart was captured from the Federal Reserve’s website yesterday (11th June), illustrating the substantial expansion of US Government borrowing. The worlds largest economy has borrowed over $3 trillion so far this year, which is expected to increase.

Along with a range of conventional measures, the members of the European Union are unifying behind a Coronavirus Relief Fund, which is hoping to raise over €500 billion to assist the member states hardest hit by the pandemic. In a historical move, the debt will be shared amongst all member states collectively, rather than just those that use it. The pandemic has been a catalyst for greater financial alignment between EU member states.

While the focus of the economic relief so far has been to protect the workforce, attention is turning to how to resurrect the economy. We can expect a range of measures globally, both conventional and unconventional, in the months to come, all aimed at boosting the speed of the recovery.

In summary, we are far from returning to pre-pandemic levels of economic activity and we face many headwinds. However, the measures taken to protect the global economy and, hopefully, soon to accelerate the recovery, have provided investors with confidence that they will be rewarded in the medium term.

Please get in touch if you have any queries or concerns. As always, we are here to help.

Disclaimer Issued by Sterling Financial Services Ltd, which is regulated and authorised by the Financial Conduct Authority. The contents of this update do not constitute advice and should not be taken as a recommendation to purchase or invest in any of the products mentioned. Before taking decisions, we suggest you seek advice from one of our qualified and authorised financial advisers. All figures and the information provided are correct at the time of writing. Past performance is not necessarily a guide to future returns, and the value of investments can fall as well as rise. You may get back less than you have invested. If you have any comments or suggestions on how to improve the monthly update or would like to be removed from our current email list, then please send an email to info@sterlingfs.co.uk or use the unsubscribe link from the Mailchimp email.