Sterling Update

Earlier this week the Office for Budget Responsibility (OBR) released their Coronavirus Analysis.

The OBR serves to provide independent economic forecasts and analysis of the UK’s Finances. In their Coronavirus report they have created a ‘reference scenario’, where they have assumed that the lockdown is in place for three months, followed by a further three months of partial lockdown. They have used this scenario as a basis to measure the impact of the virus on the economy. The OBR are clear in their report that their lockdown assumption just represents a point of reference for their forecast, which will be adjusted and adapt to the relaxing of social distancing measures as they happen. It is purely a starting point.

The media condensed some of the OBR findings into particularly negative headlines. However, after reviewing the analysis more objectively, we felt there were two key takeaways from the report – the estimated recovery time and the potential financial cost of the outbreak, which we have summarised below: –

OBR Recovery Forecast

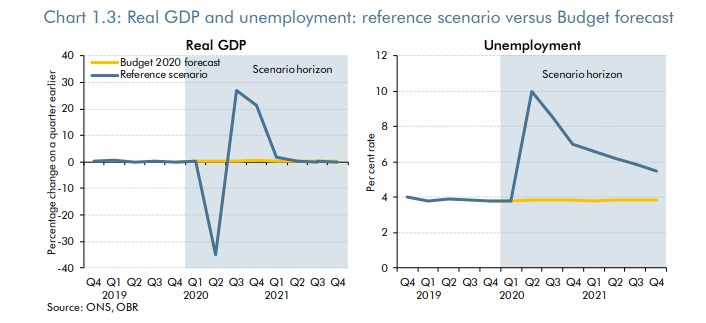

The chart below, taken from the OBR Analysis (based on the six-month disruption scenario), forecasts the economy to return to pre-outbreak levels in around 12-18 months. Unemployment will take longer to recover but will (obviously) improve sharply when the lockdown ends. It should be noted that the pre-outbreak unemployment rate was particularly low by historical standards.

OBR National Debt Forecast

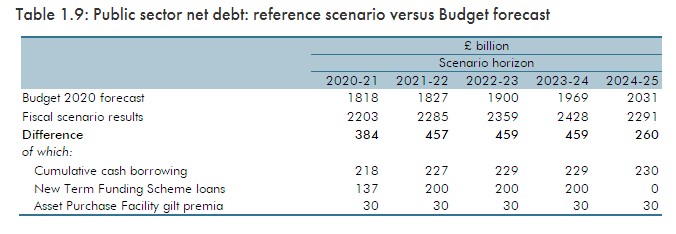

Clearly, closing the economy while supporting businesses and households will be costly, but not catastrophic. Based on the six months of disruption assumption, the OBR estimates that by the 2024-25 tax year, the National Debt will be 12.80% higher than pre-outbreak expectations. Of course, there will be a sharp increase in borrowing during the next few years before the debt will reduce. Please bear in mind the cost of borrowing (the interest paid on the debt) is substantially low by historical standards. The table below, again taken from the OBR analysis, estimates the national debt over the next five years.

Impact on Investments

It is important to recognise that investment markets tend to work in advance of the real economy. The pandemic will ultimately pass, but investors would usually expect a recovery in investment valuations prior to economic conditions returning to normal. Also, investors should remain mindful that the markets are confidence driven. While some countries have started to relax distancing measures, there are still many unknowns. Until it can be evidenced that the pandemic has been contained, or at least that a more relaxed approach is working, it is unlikely that a recovery in investment valuations will be sustainable.

In summary, the OBR forecast, based on six months disruption, suggests that the downturn will be short lived, recover with reasonable speed and see the National Debt around 13% higher than anticipated in five years. Unemployment will return to its longer-term average within relatively short order. Investment markets are waiting for more direction, closely observing those countries relaxing social distancing and vaccine development. Volatility will remain in the meantime.

For those that wish to review the OBR report in full, please head to their website https://obr.uk/coronavirus-reference-scenario/

As always, we are here to help. Please get in touch if you have any queries.

Disclaimer Issued by Sterling Financial Services Ltd, which is regulated and authorised by the Financial Conduct Authority. The contents of this update do not constitute advice and should not be taken as a recommendation to purchase or invest in any of the products mentioned. Before taking decisions, we suggest you seek advice from one of our qualified and authorised financial advisers. All figures and the information provided are correct at the time of writing. Past performance is not necessarily a guide to future returns, and the value of investments can fall as well as rise. You may get back less than you have invested. If you have any comments or suggestions on how to improve the monthly update or would like to be removed from our current email list, then please send an email to info@sterlingfs.co.uk or use the unsubscribe link from the Mailchimp email.